Utility and Tax Incentives

Federal, state, and local governments understand the importance of sustainable energy and the high costs associated with traditional power sources. Utility companies can’t afford to maintain their infrastructure costs as homes use more and more power. That’s why, in most cases, utility and tax incentives can save customers well over 50% on the cost of energy.*

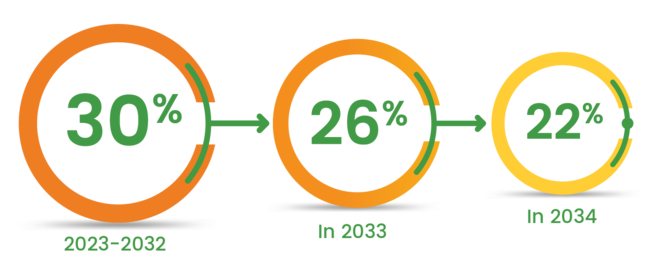

Federal Investment Tax Credit – 30%

The solar investment tax credit (ITC) is a dollar-for-dollar reduction in the income taxes that a homeowner claiming the credit would otherwise pay the federal government. The ITC is based on 30% of the cost to install solar for systems installed in 2023–2032. For those leasing a system, tax credits are not offered. Don’t wait; prices for solar equipment are on the rise!

*Ask your representative about which incentive you’re eligible to receive. Please consult a tax advisor on your ability to claim these nonrefundable tax credits.

Arizona Incentives

The Residential Arizona Solar Tax Credit reimburses homeowners 25 percent of the cost of the solar panels, up to $1,000, right off of their personal income tax in the year the system was installed. If the amount of the credit exceeds a taxpayer’s liability in the year of installation or beyond, the unused portion of the credit may be carried forward for up to five years. You might also qualify for utility-specific incentives. Don’t worry; your energy consultant will make sure you don’t miss out on any perks.

Nevada Incentives

Nevada has a favorable net metering policy compared to some other states. A solar power system sized at 25 kW or less can get a monthly credit for excess energy production at 75% of retail rates. However, the customer can’t accumulate net metering credits that exceed 100% of their annual consumption. In other words, a solar panel system that overproduces energy would not yield extra benefits.

NV Energy, the largest utility company in Nevada, offers an Energy Storage Incentive Program with rebates for battery systems coupled with solar panels. The incentive rate depends on the customer’s electric tariff: time-of-use (TOU) or non-TOU tariffs. The incentive is available for solar battery systems with a rated power output between 4 kW and 100 kW. The rebate is limited to 50% of project costs up to $3,000 for TOU tariff customers and up to $1,500 for other customers.

Property Tax Exemption – 100% through 2024

Installing solar panels on your home increases its value by up to 20 times your annual energy bill savings. We don’t think you should be penalized for your sustainable decision, and many state legislators agree! Until the end of 2024, new solar installations will be subject to no additional property taxes based on their assessed value.

Increase Home Value

Having a residential solar energy system on your property is known as a capital improvement, which adds to your property’s value. This means that you can potentially sell your home faster and for more than homes without solar. Your investment in efficient, clean solar power also adds to the tax basis of your home. If you sell the home, this tax-based investment can be deducted from the sale’s price, reducing the amount of the price that is counted as profit. This reduces the taxes taken from the sale and may be able to help you avoid capital gains taxes on the appreciation.

*Ask your representative about which incentive you’re eligible to receive. Please consult a tax advisor on your ability to claim these nonrefundable tax credits.