Electric Vehicle Incentives

There are valuable federal, state, and utility incentives* that can help you pay for your electric vehicle and home charging. From the ITC credits you’ll receive for the purchase of an EV, solar, and storage to local state and utility rebates, now is a great time to use sustainable energy for your home and car!

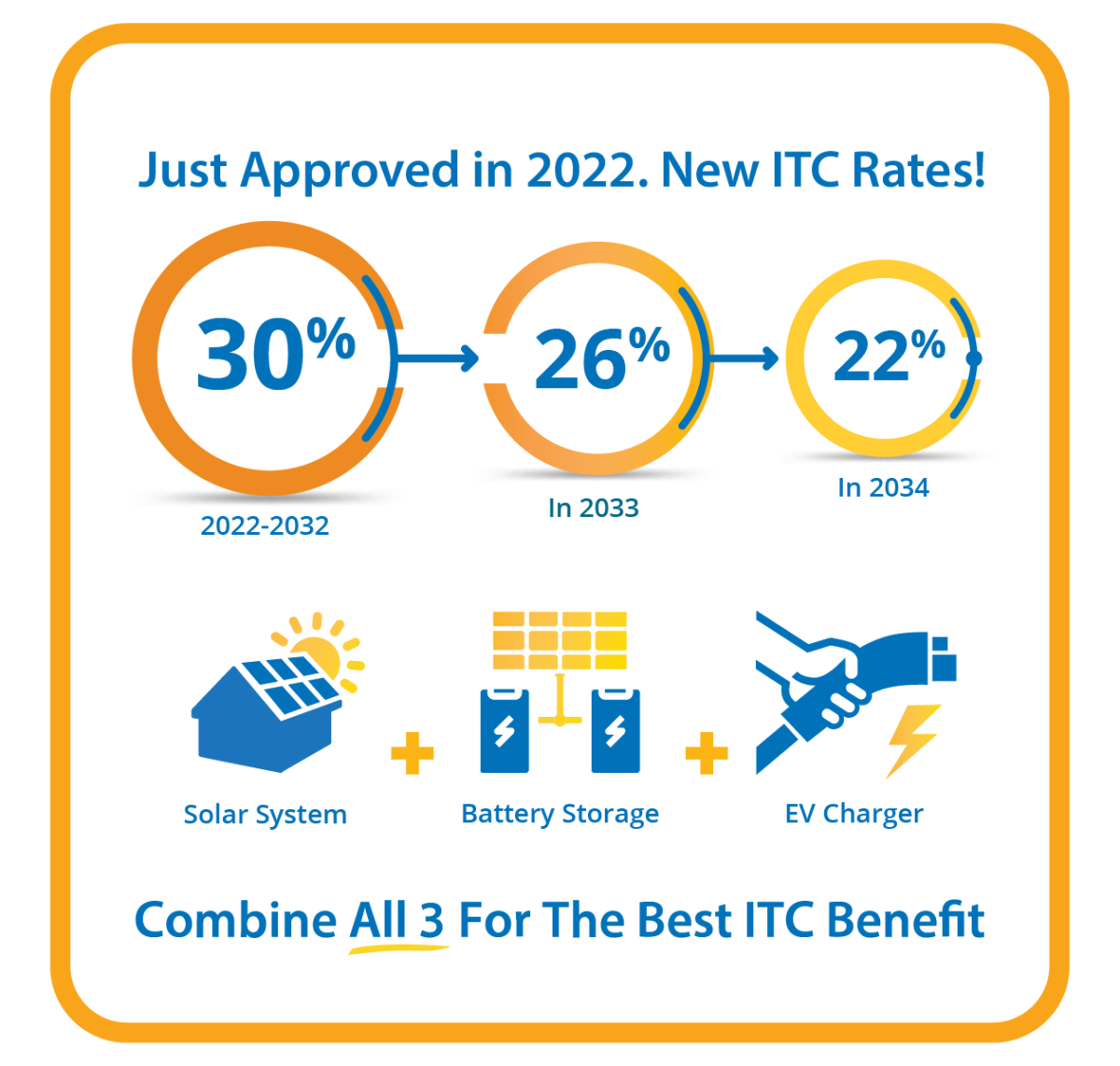

Federal Investment Tax Credit

Electric Vehicle Chargers will qualify for ITC credits when combined with a home residential solar system or storage installation. Make sure to include all your energy efficiency upgrades as part of your SUNSOLAR SOLUTIONS contract to receive the greatest value.

Arizona Utility Incentives

The state of Arizona has a plethora of favorable laws, incentives, regulations, funding opportunities, and other initiatives related to alternative fuels and vehicles, advanced technologies, and air quality. Below are the Utility incentives.

Arizona Public Service Company (APS)

- Electric Vehicle (EV) Time-Of-Use (TOU) Rate – APS offers a TOU rate for residential customers who own an EV. For more information, see the APS EVs and Rates, Schedules, and Adjustors websites.

- Electric Vehicle (EV) Charging Station Rebate – APS offers residential customers a $250 rebate for the purchase of a qualifying Level 2 EV charging station. Additionally, customers who enroll in the APS Smart Charge Program may earn an $85 bill credit every year. For more information, including eligibility requirements, see the APS EV Smart Charger Rebate and SmartCharge Rewards websites.

- Electric Vehicle (EV) Charging Station Pilot Program – APS offers free EV charging stations, installation, maintenance, and educational services to its workplace, fleet, and multi-unit dwelling customers through the Take Charge AZ pilot program. For more information, including eligibility, see the APS Take Charge AZ website.

Salt River Project (SRP)

- Residential Electric Vehicle (EV) Charging Station Rebate –SRP offers residential customers a $250 rebate for the purchase of a qualifying Level 2 EV charging station. A $50 bill credit is available for customers who join the SRP EV Community. For more information, including eligibility requirements, see the SRP EV Benefits and Savings website.

- Electric Vehicle (EV) Time-Of-Use (TOU) Rate – SRP offers a TOU rate for residential customers who own or lease an EV. For more information, including how to enroll, see the SRP EV Price Plan website.

- Commercial Electric Vehicle (EV) Charging Station Rebate – SRP offers rebates to commercial customers who install networked Level 2 or direct current fast charging (DCFC) stations. Government, non-profit, school, and multifamily customers are eligible for higher rebate amounts.

| EV Charging Station Type | Standard Rebate | Increased Rebate |

|---|---|---|

| Networked Level 2 | $1,500 per port; up to 75 ports | $4,000 per port; up to 75 ports |

| DCFC | $15,000 per port; up to three ports | $20,000 per port; up to three ports |

EV charging stations must be installed between May 1, 2022, and April 30, 2023. Rebates are available on a first-come, first-served basis. For more information, including how to apply, see the SRP Business EV Charger Rebate website.

Commercial Electrification Assessment Incentives

SRP offers commercial customers rebates of up to $20,000 for completing an electrification fleet assessment through the Fleet Advisory Services Program. Eligible fleets include may include light-, medium-, and heavy-duty vehicles. Rebate amounts vary by fleet size and vehicle classification. For more information, including eligibility requirements, visit the Electrification Rebates and Business EV Charger Rebate website.

Tucson Electric Power (TEP)

- Electric Vehicle (EV) Charging Station Rebate – TEP offers residential customers a rebate of up to $500 for the purchase of a Level 2 or direct current fast charging (DCFC) station. Rebate amounts vary by EV charging station amperage. For more information, including how to apply, see the TEP EV Rebates website.

- Electric Vehicle (EV) Charging Rates – TEP offers three time-of-use (TOU) rates for residential customers with EVs. For more information, see the TEP Rates for EV Owners website.

- Commercial Electric Vehicle (EV) Charging Station Rebate (TEP) – TEP offers rebates and technical support to businesses, multifamily dwellings, and non-profit customers that purchase and install between two to six EV charging station ports. TEP will evaluate the electrical capacity and supporting EV charging station infrastructure at locations that install six or more ports on a case-by-case basis. Higher rebates are available for commercial customers located in low-income areas. Low-income areas are defined as U.S. Census tracts where the average household income does not exceed 80% of the median Arizona household income. Rebates are available in the following amounts:

| EV Charging Station Type | Location | Rebate | Low-Income Area Rebate |

|---|---|---|---|

| Level 2 | Workplace | $4,000 per port; up to 75% of project cost | $6,000 per port; up to 75% of project cost |

| Level 2 | Multi-Family Dwelling or Non-profit Organization | $5,400 per port; up to 85% of project cost | $9,000 per port; up to 85% of project cost |

| Direct Current (DC) Fast Charger | All | $20,500 per port; up to 75% of project cost | $40,000 per port; up to 75% of project cost |

For more information, including project eligibility and how to apply, see the TEP Smart EV Charging Program website.

Mohave Electric Cooperative (MEH)

- Electric Vehicle (EV) Charging Station Rebate – MEH offers residential and commercial customers rebates for the purchase of networked Level 2 or direct current fast charging (DCFC) stations. Residential and commercial customers are eligible for rebates of $1,000 and $2,750, respectively. For more information, see the MEH EV Charging Rebate website.

Manufacturers Discounts

For vehicles placed in service on or after April 18, 2023, the credit amount will depend on the vehicle meeting the critical minerals requirement ($3,750) and/or the battery components requirement ($3,750). A vehicle meeting neither requirement will not be eligible for a credit, a vehicle meeting only one requirement may be eligible for a $3,750 credit, and a vehicle meeting both requirements may be eligible for the full $7,500 credit.

For vehicles placed in service before or on April 17, 2023, the credit is calculated as a $2,500 base amount plus, for a vehicle that draws propulsion energy from a battery with at least 7-kilowatt hours of capacity, $417, plus an additional $417 for each kilowatt hour of battery capacity in excess of 5 kilowatt hours, up to an additional $5,000 beyond the base amount. In general, the minimum credit amount will be $3,751 ($2,500 + 3 * $417), representing the credit amount for a vehicle with the required minimum of 7 kilowatt hours of battery capacity. Learn more.

The credit is nonrefundable, so you can’t get back more on the credit than you owe in taxes. You can’t apply any excess credit to future tax years. Learn more.

For vehicles purchased in 2022 or before, credit eligibility was determined under different criteria.

*Ask your representative about which incentive you’re eligible to receive. Please consult a tax advisor on your ability to claim these nonrefundable tax credits.